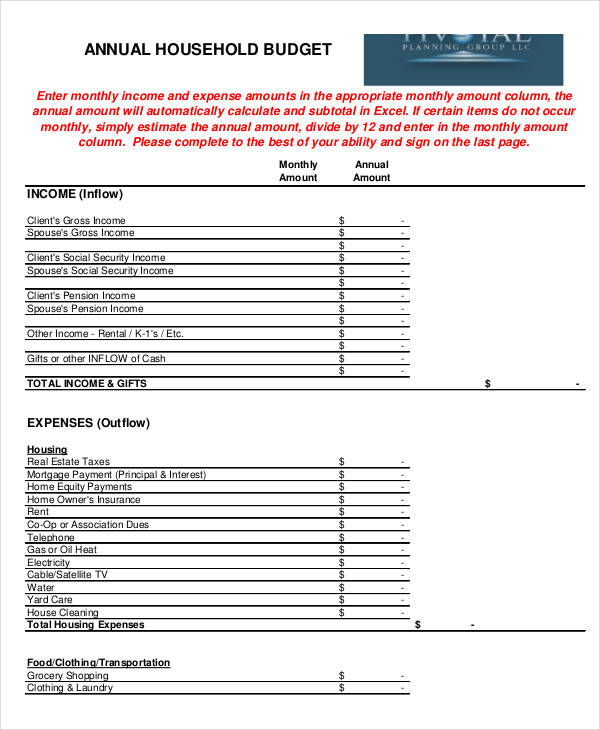

By visualizing your expenses and financial goals, you'll be able to see exactly where your money goes. Whether you're managing the office budget of a small business or need to track your personal expenses, using a template makes it easier to stay organized. Monitor all of your home or business expenses accurately and decide what areas of your budget can be better managed.

Simplify your monthly or weekly budgeting by using a free, customizable budget template. The above mentioned stakeholder organization is responsible for the distribution of this document.Reaching your financial goals takes careful planning and saving-using the right tools is the first step to budgeting effectively. CMHC stakeholders are permitted to distribute the materials at their expense. Neither CMHC and its employees nor any other party identified in this Article (Lender, Broker, etc.) assumes any liability of any kind in connection with the information provided. The information is believed to be reliable, but its accuracy, completeness and currency cannot be guaranteed. It does not provide advice, and should not be relied upon in that regard.

The information is provided by CMHC for general illustrative purposes only, and does not take into account the specific objectives, circumstances and individual needs of the reader.

YEARLY PERSONAL BUDGET TEMPLATE PROFESSIONAL

Ask your mortgage professional about CMHC. CMHC is Canada's largest provider of mortgage loan insurance, helping Canadians buy a home with a minimum down payment starting at 5%. Make sure you add these other costs when you fill out this form.įor more homebuying tips, visit CMHC's interactive Step by Step Guide. Note: You may have other costs not shown on this worksheet. DetailsĮntertainment, eating out, recreation, moviesĭental expenses, medical expenses, prescriptions, eye wear Use the following worksheet to help develop your budget. If you continue to spend more than you make, you must find ways to spend less. You should watch what you spend each month and see if you are getting closer to meeting your financial goals. Preparing a monthly budget - and sticking to it - is one of the keys to successful homeownership. Other funding and financing opportunities.Federal/Provincial/Territorial housing agreements.

The National Housing Strategy Glossary of Common Terms.New social housing buildings for women in Montreal.Indigenous and the North Housing Solutions.Contact your multi-unit housing solutions specialist.Travel, hospitality and conference expenditures.Access to information and privacy protection.Joint auditors special examination report to CMHC board 2018.COVID‑19: eviction bans and suspensions to support renters.One-Time Top-Up to the Canada Housing Benefit.Finding or advertising a rental property.Mortgage financing options for people 55+.COVID-19: understanding mortgage payment deferral.CMHC - home renovation financing options.Do I qualify for mortgage loan insurance?.Resources for Members of the Federal, Provincial and Territorial Forum on Housing.Federal, Provincial and Territorial Forum on Housing.CMHC licence agreement for the use of data.Residential Mortgage Industry Data Dashboard.Prohibition on the Purchase of Residential Property by Non-Canadians Act – Frequently asked questions.Prohibition on the Purchase of Residential Property by Non-Canadians Act.COVID-19: CECRA for small businesses has ended.Insured Mortgage Purchase Program (IMPP).

YEARLY PERSONAL BUDGET TEMPLATE HOW TO

How to recognize and report mortgage fraud.Default, claims and properties for sale.Default Management Request Submission Tool.Homeowner Business Transformation (HBT).Homeowner and small rental mortgage loan insurance.Rental Construction Financing Initiative.National Housing Strategy Project Profiles.

0 kommentar(er)

0 kommentar(er)